Part 3: What Are the Benefits of a Going Out of Business (GOB) Sale?

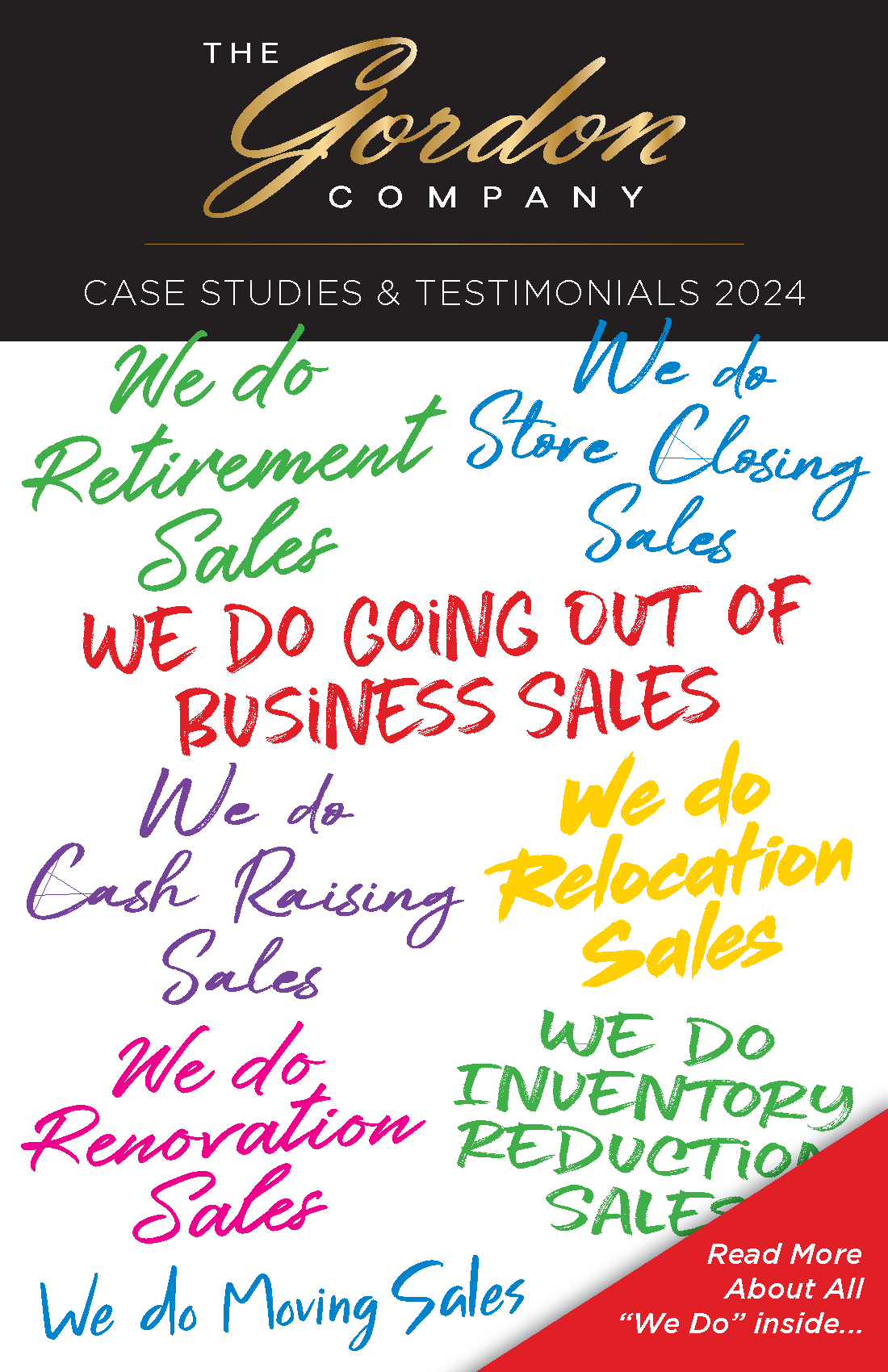

In my two previous messages, I shared views on whether selling a retail jewelry store to an outside party is a viable option, and thoughts you might consider in turning a business over to a family member. In this message, I want to discuss the various aspects of having a Going Out of Business Sale Event.

To begin with, if you are convinced that you want out of all involvement with the jewelry business and want to ride off into the proverbial sunset, then a Going Out of Business Sale is probably for you. You should also know that a GOB Sale will produce the absolute best return on your life’s investment, for it is common that a fine jewelry store can do a year’s plus worth of business in only two-plus months during the extended holiday selling season.

But before you decide on a GOB Sale, you need to make sure that you really can retire completely because a lot of people opt for retirement and then regret not having something to do with their time. Have you developed hobbies that excite you, travels that you have contemplated for years, grandchildren to spend more time with, and other life experiences that you want to have? Because some jewelers question whether they want to get out completely, they opt for a retirement/store closing sale and choose to open a small office upstairs to become a “by appointment only private jeweler.” We are seeing more and more of this in recent years.

The two most important issues you need to consider are financial and personal/emotional. Can you afford to retire? Can you walk away from a lifetime of work? Are you emotionally prepared for the next stage in life? Are you okay with leaving your customers, employees, and other relationships in the business? Chances are, if you can answer yes to these questions, you will be best served by having a GOB Sale because the lump sum money you will receive will be worth it.

You’ll need this because you and your spouse/partner will want to at least maintain your current lifestyle, and have the funds to travel, expand on your hobbies, and enjoy the fruits of your labor. You must also make sure that you can live comfortably well into your 90s today, and that you have the money to afford proper medical care in those latter years.

So there you have it. A Going Out of Business Sale has worked for thousands of people over the years, and it can work for you, too. If we can be of help by answering questions, setting you up with projections, and sharing our expertise, please don’t hesitate to contact us.

Sincerely,

Jeff Gordon, CEO