The recent failure of SVB Bank has put a punctuation point on the uncertainly surrounding the economy and what 2023 and ’24 will bring. Coupled with inflation, interest rate hikes, a slowing housing market, lower consumer sentiment, and a possible recession, our advice is to hunker down and maintain cash flow and liquidity.

According to the Jewelers Board of Trade, store closings in 2021 and ’22 were down from previous years with retail jewelry business at all-time highs. Disposable personal income was up during these years and travel was way down. Most jewelers felt a slowdown in the second half of 2022 and this has spilled over into 2023.

But despite our low unemployment, major layoffs taking place, and personal savings rates about half of what they were just a year ago, consumers are still spending. But what are they spending on? Travel is up over pre-pandemic levels and it is eating into discretionary spending for many Americans.

What does all this confusion in the economy and marketplace mean for you as a fine jeweler? Despite inflation, cash is still king and debt is a millstone around any business owner’s neck. This is a time to remain agile and to ensure that you have very little debt and good cash flow, retaining what you have worked all your life for. Tightened inventory levels are important. The old adage “prepare for the worst and hope for the best” is not a bad mantra during this time.

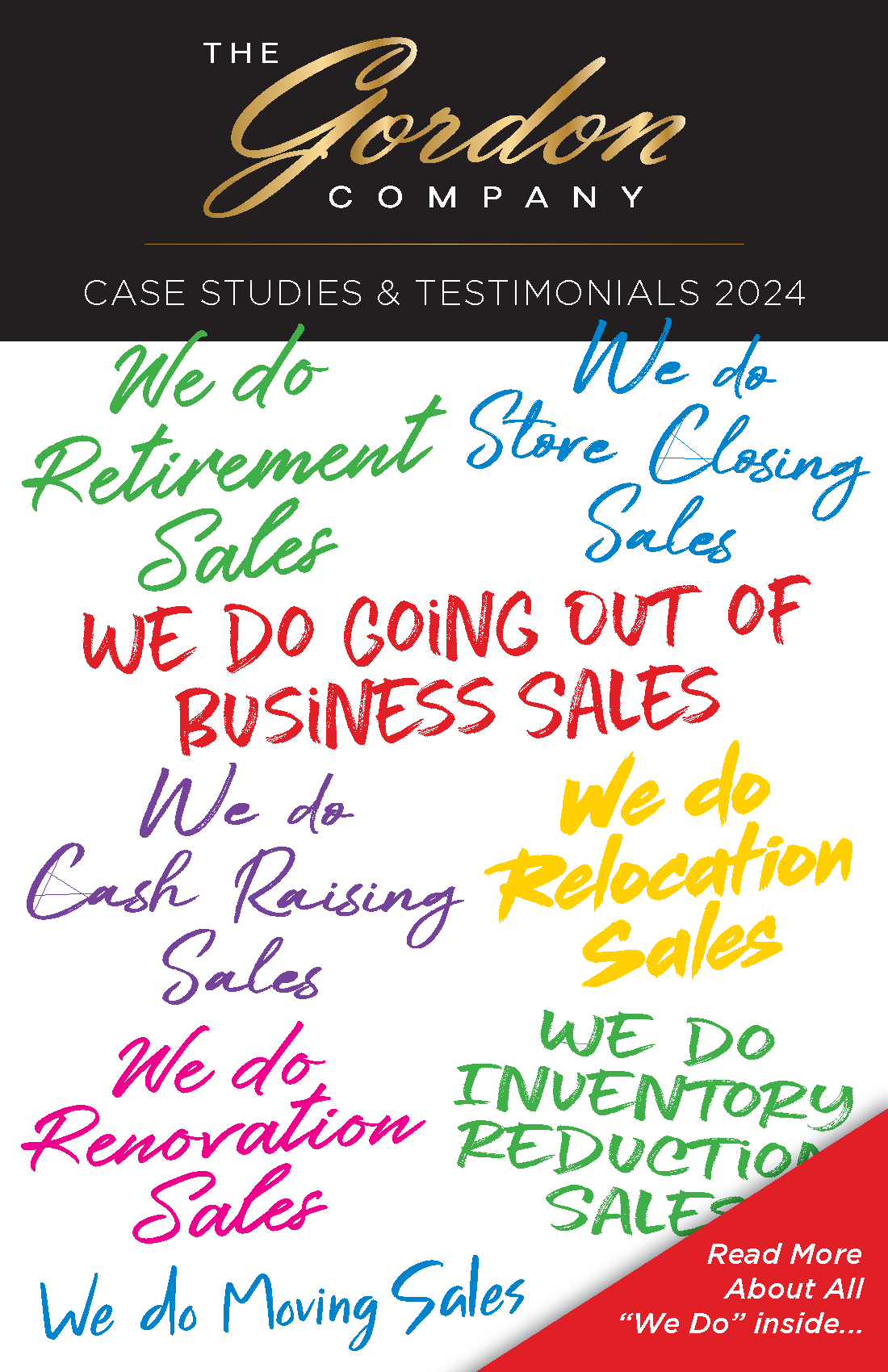

At The Gordon Company, our role in the industry is to help jewelers monetize aged merchandise, improve cash flow, and reduce debt. If this is what you need in a year that requires some serious belt-tightening, give us a call to see how we can help.

Sincerely,

Jeff Gordon, CEO