The recent Chapter 7 filing of WD Diamonds calls for a complete liquidation of its assets totaling some $3 million, while debt amounted to some $44 million.

WD is a former market leader in large, fine quality lab-grown diamonds, so its filing sends a strong message to the jewelry industry. Rapid expansion of manmade diamond production in low-cost centers like India and China had a big impact on U.S.-based WD. Price drops in lab-grown diamonds have been significant over the past 12 months and will likely drop even further, putting even more pressure on the gross profit dollars of retail jewelers.

Similarly, a slowdown has been felt in luxury goods recently. As reported by Consensus, “the end of easy money is catching up with luxury brands.” LVMH shares fell 6% after it reported a slowdown in sales for the third quarter of 2023. A similar slowdown has been felt by many retail jewelers as rapid growth in travel has taken discretionary dollars away from jewelry purchases.

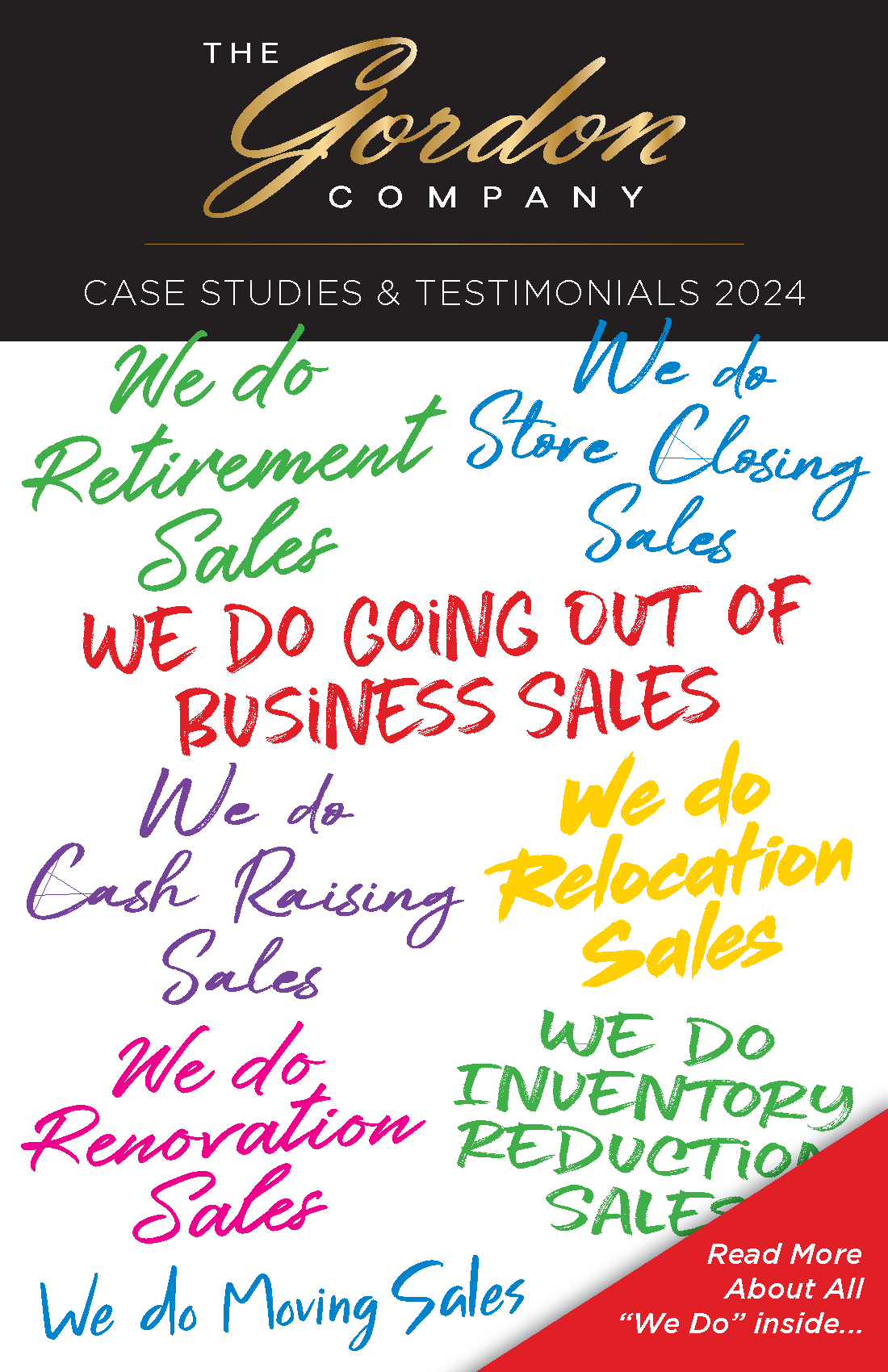

All is not lost for retailers, but the softness in the economy and uncertainty in global affairs certainly takes a toll on consumer sentiment and spending. At The Gordon Company, we watch for all signs of economic complexity and provide marketing and financial solutions to combat the fears of independent retail jewelers.

Contact us today to see how we can help you get through what will most certainly be a challenging holiday season and a more challenging 2024.

Sincerely,

Jeff Gordon, CEO