As if there aren’t enough things to keep you up at night while running an upscale retail jewelry business, debt seems to be the one that causes the most sleepless nights. I’m not referring to long term debt such as mortgages or short-term debt with suppliers, unless your cash flow is so bad that you simply can’t keep up.

Banks aren’t loaning money to jewelers and are inclined to pull lines of credit these days, leading to problems mounting very quickly. And even if they don’t, untenable interest rates, especially from finance companies, can wreak havoc on your business and cause undue stress.

We see a lot of very fine stores today that are in this predicament. High-interest rates contribute to greater costs that put pressure on cash flow and profitability. Keeping overhead low is a fundamental of every business today, but it’s tough to do when you want to expand and grow your business.

One of the key issues that faces every jeweler is burdensome inventory from suppliers that simply doesn’t sell. This contributes to poor cash flow, and a necessity to make decisions that don’t come easy. How to monetize aged and unwanted merchandise becomes a central issue for all jewelers. Fortunately, there are options to consider that will eliminate unwanted inventory, increase cash flow, provide for investment in fast-selling merchandise, and most importantly, reduce or even wipe out burdensome debt.

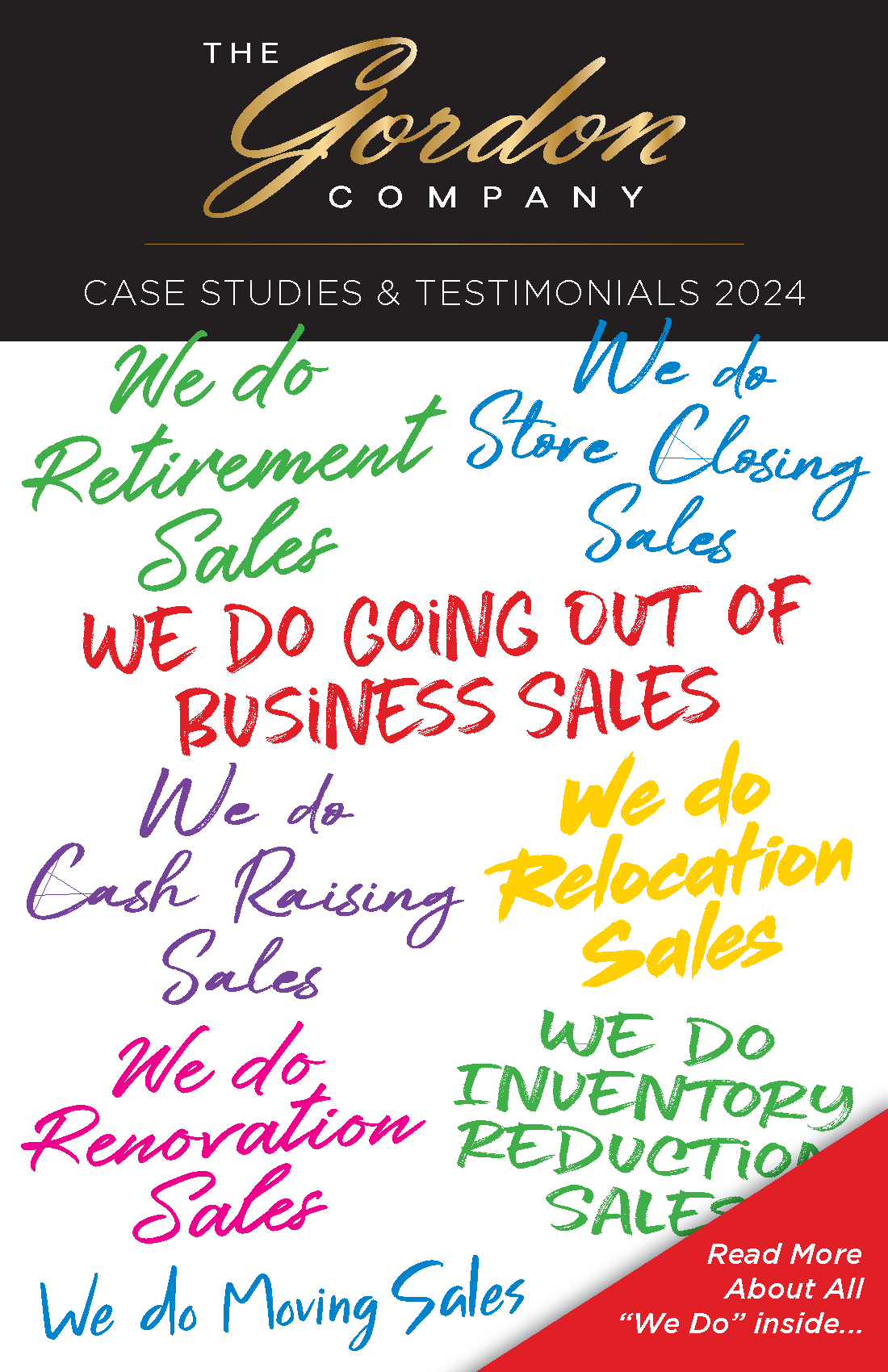

At The Gordon Company, we specialize in major sale events that provide for inventory clearance and reduction of debt. Let us help you get your sleep back at night if these issues are keeping you up. We look forward to hearing from you.

Sincerely,

Jeff Gordon, CEO