Despite the corporate and individual tax cuts enacted last year, we hear a lot of reporting about reduced tax refunds this Spring. This tells us that retail jewelers are going to be hit two ways: The first is personally and the second is through less disposable income from customers.

Upscale jewelers are marketing mostly to the upper middle class and wealthier people who have fairly significant income and/or resources beyond the average person. Dual income households are common, and this gives many people an edge to purchase jewelry that single income households simply don’t have. But if their tax refunds are lower, and if they don’t “feel” as comfortable with their capital – as was the case last Christmas Season with the jittery stock market, the Fed hike, the China trade deal question mark, and other confidence shakers – then they will hold off on discretionary purchases, at least for the time being.

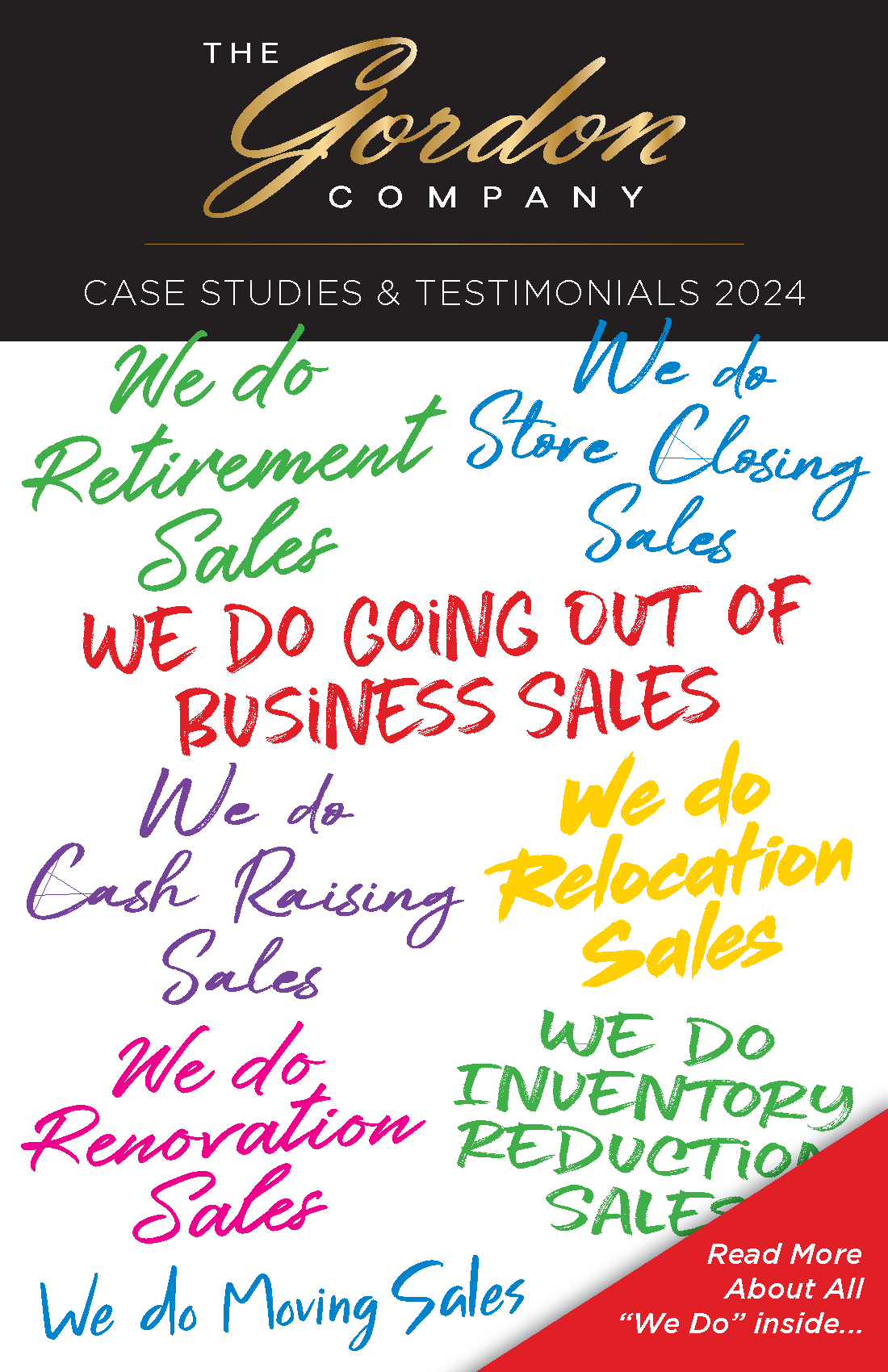

We get calls from jewelers every day, and the reasons cover the gamut. Some feel it’s time to retire and have a sale event to monetize their inventory holdings. Others are closing a store, reducing their footprint, moving more to custom, or going from two stores to one. Yet others are looking for increased traffic through an expanded mailing list and better cash flow. And still others are concerned about bank debt, supplier debt, mortgage debt, and personal debt, and want to get out of debt to ease their minds and the stress that debt presumes upon them.

If this is you, we have an answer. Let us help you get out of debt, free your mind, and start over fresh with a sale event that will accomplish all of this and more. The expanded mailing list you will get from new customers alone will be a boon to your business for years to come.

For a free, confidential consultation feel free to reach out directly to our President Ira Bergman 917-861-9607 ibergman@gordonco.com, or Vice President Barry Lustig 917-586-1984 blustig@gordonco.com.

Sincerely,

Jeff Gordon, CEO