Everything we read about today tells us to be conservative and to hold on to our money. Interest rates are still high, so borrowing is difficult. Financing growth in these uncertain times makes little sense right now. Inflation is still higher than any of us want and we continue to hear news about a possible recession.

Most prognosticators are predicting a soft market over the next 15 months. There are opportunities in every market climate, but it is time to tighten things up, be strategic in buying, and convert aging inventory into cash for that proverbial “rainy day.”

The key question is this: Do you want to be drowning in inventory or would you rather be swimming in cash when Cash Is King?

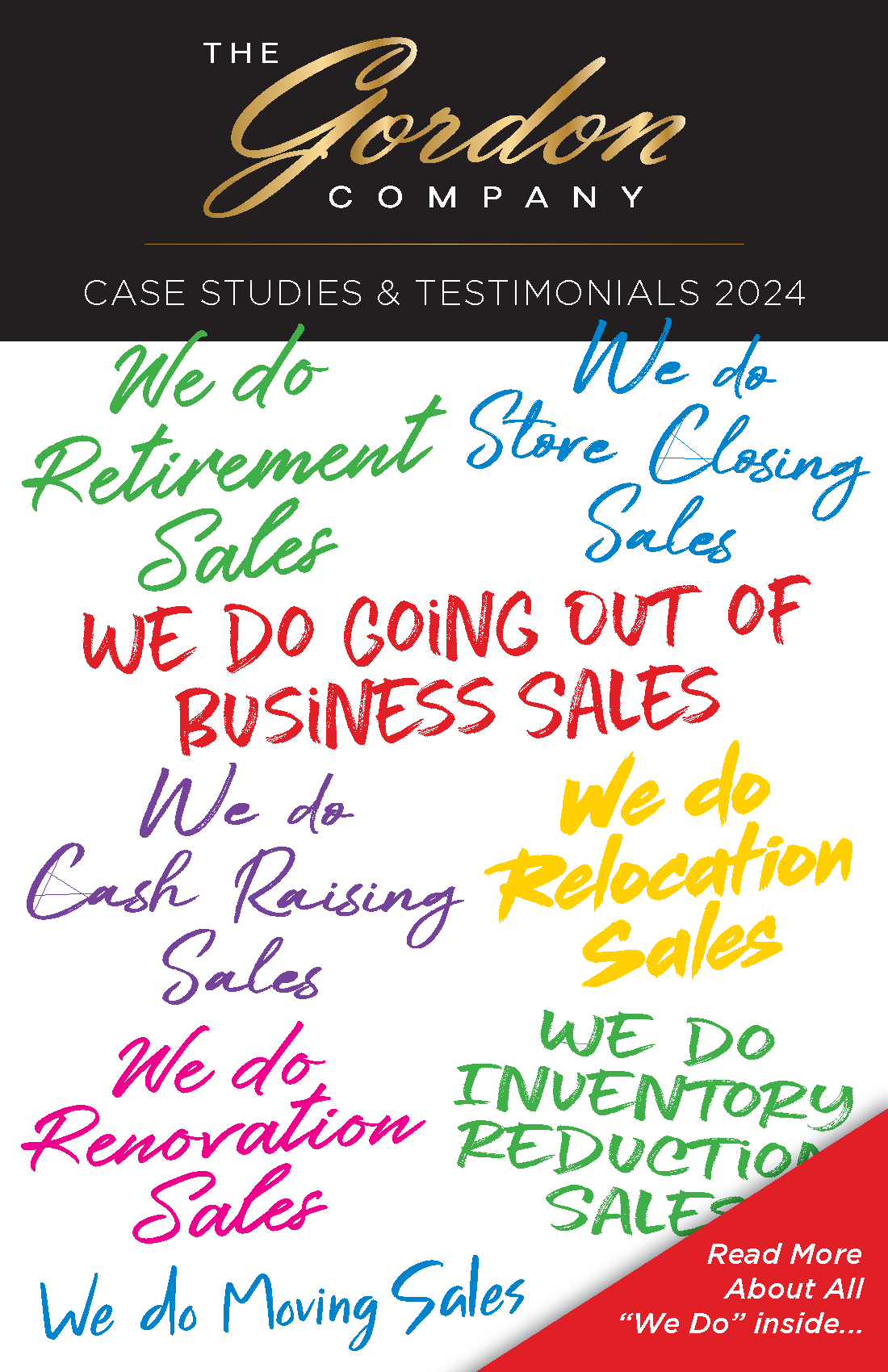

The way to get the cash you need to weather the storm is to run a major sale event. You will monetize your aged merchandise and secure a solid financial hold on whatever the near-term economy brings.

In challenging times, you need a support system you can rely on. At The Gordon Company, we have helped hundreds of jewelers over many years get back into a position of strength. Let us help you, too.

Contact us right away for a confidential, no-obligation look at your financial situation. We are happy to provide a free consultation of your needs.

Sincerely,

Jeff Gordon, CEO