If you are at a point of calling it quits, cashing in, transitioning your business, restructuring it to a different form, or just in need of a jump start for the year, you are at one of the most crucial times in your business since you started it or took it over. How can you maximize your return on investment and create a result that meets your individual needs? The good news is: You have options.

You can try to sell your store to a qualified buyer. Unfortunately, there aren’t many, and those less qualified will have a hard time getting a loan from a bank or generating enough cash to buy it. Then there’s the question of price. Most jewelers think their business is worth more than what the actual books will show. Often a son or daughter or relative has demonstrated the ability to run the business effectively, but then how are they going to pay you? Usually over years, with some degree of measured risk to you if they falter.

Scrapping it will give you the least amount of return, maybe 15 or 20% of what you have in it. So what about selling it to a close-out merchant? I guess that will work. But what will he give you? Maybe just a touch over scrap. It still isn’t worth it.

Since most of your assets are tied up in inventory, you must monetize a great portion of it in order to retire comfortably, or transition the business to a new owner, often a son or daughter. That’s a big reason why inventory liquidation sales have been so effective over the years. A sale event is a very reasoned way of getting the majority of your capital investment back in the form of cash, and over a relatively short, two-month period of time. It involves some hard work – but that’s what we do for you. We take the weight off your shoulders as expert facilitators while you enjoy an eight week sales extravaganza like the holiday season on steroids. A major sale event is well worth the effort, as many of our satisfied clients will attest to.

These and other methods are reasonable ways to liquidate unwanted jewelry, but there’s still no guarantee the merchandise will sell, and it costs you money just to hold on to it. So what gives you the best return on your investment for merchandise you need to liquidate?

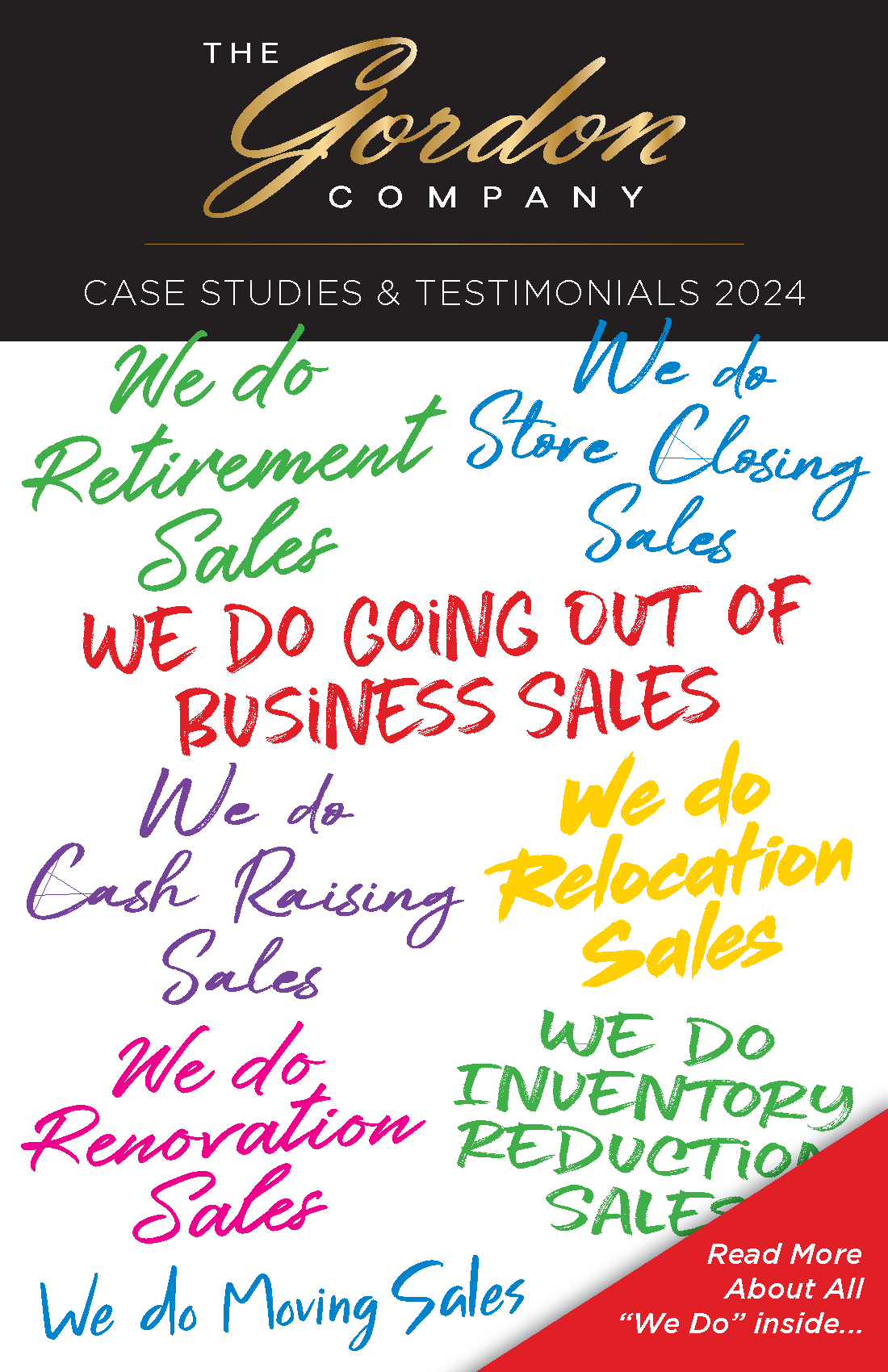

At The Gordon Company, our goal is to advise you on the best course of action for you individually. Everyone is different and has unique needs all their own. Our expertise is in coming up with creative ways to make your exit and/or transition as smooth and as profitable as possible. I can’t possibly share more with you in this brief message, but I welcome your call to learn more about how we can help you.

Our business is to help you stay in business with inventory solutions that will free you to pay off debt, invest in fresh merchandise, develop new designers, expand your mailing list, and prepare for a successful future. Contact us today for a free, confidential, no obligation consultation.

Sincerely,

Jeff Gordon